“What if your salary suddenly increased, but so did your expenses?”

This wasn’t a what-if scenario in 2018. It was reality. When the Tax Reform for Acceleration and Inclusion (TRAIN) Law, or the Republic Act No. 10963, took effect, it rewired how the country taxed its citizens.

The TRAIN Law promised to make the Philippine Tax System simpler, fairer, more equitable, and more efficient to promote investments, create jobs, and reduce poverty.

But what did it really change? Why should you care? Let’s break it down.

What is TRAIN Law?

Signed into law on December 19, 2017, and effective January 1, 2018, the TRAIN Law was Package 1 of the Comprehensive Tax Reform Program (CTRP). Its goal is to rebalance the tax burden—reducing personal income taxes while increasing excise taxes on certain goods and broadening the value-added tax (VAT) base.

“The TRAIN law adjusted personal income taxes and fixed the inequity of our tax system. We want our taxpayers to reap the fruits of their labor while enabling them to contribute their fair share to national development,” said Finance Secretary Benjamin Diokno.

Key Features of TRAIN Law

1. Lower Personal Income Tax

One of TRAIN’s most popular provisions was the reduction in personal income tax for the majority of workers:

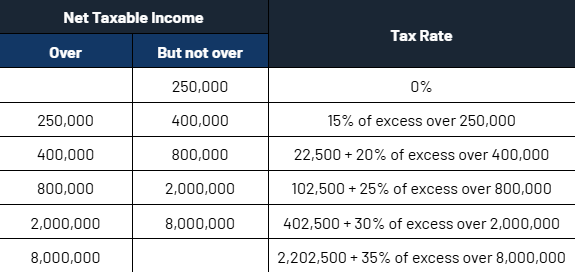

Individuals earning ₱250,000 and below annually are now exempt from income tax. Progressive rates from 20% to 35% apply to higher earners (RA 10963, Sec. 24(A)).

This means more take-home pay for employees, especially those in the lower brackets.

2. Higher Excise Taxes on Select Goods

To offset revenue losses, TRAIN increased excise taxes on:

- Petroleum products, such as gasoline and diesel.

- Sugar-sweetened beverages (₱6 – ₱12/liter depending on the type).

- Tobacco products, with a phased increase over several years (by 2024, 4% increase every year thereafter)

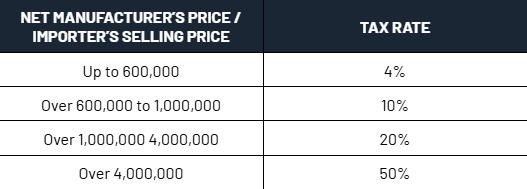

- Automobiles, based on price tier.

- Coal, which faced a sharp rise from ₱10/metric ton to ₱150 by 2020.

These were designed not only to raise funds but also to encourage healthier and more sustainable consumption habits.

3. Broadened VAT Base

While VAT remained at 12%, TRAIN removed several exemptions to simplify the system and improve collections. Exemptions previously granted to some cooperatives and other sectors were rationalized.

4. Tax on Passive Income and Luxury Items

- Stock transaction tax increased from 0.5% to 0.6%.

- Interest income on foreign currency deposits rose to 15%.

- Lotto winnings above ₱10,000 are now taxed at 20%.

- Higher documentary stamp taxes on various financial instruments.

These changes reflect a move toward taxing wealth and consumption rather than labor.

Putting TRAIN Law into Perspective

The TRAIN Law introduced substantial changes to the Philippine tax system by restructuring how income, consumption, and wealth are taxed. While it promised to ease the tax burden on low- and middle-income earners and generate funds for government programs, its implementation also led to notable adjustments in the cost of living and business operations.

As with any major reform, TRAIN continues to draw mixed reactions—praised by some for its efforts toward equity and modernization, and critiqued by others for its economic ripple effects, particularly on consumer prices.

Ultimately, the TRAIN Law marks a significant shift in fiscal policy. Whether one views it as progressive, burdensome, or necessary, it remains important to understand its mechanics and monitor its long-term impact on both individual taxpayers and the broader economy.

Disclaimer: The content of this blog is for informational and educational purposes only and should not be considered as legal advice. While we strive to provide accurate and up-to-date information, the blog does not create an attorney-client relationship. For legal concerns or specific legal guidance, please consult a qualified lawyer.

To read more STLAF legal tidbits, visit www.sadsadtamesislaw.com/bits-of-law.

For comments, suggestions, and inquiries, email legal@sadsadtamesislaw.com.

Author/s: Patricia Minimo

About the author: Patricia is STLAF's Legal Writer-Researcher. She is a Communication graduate from the University of the Philippines – Baguio with a major in Journalism and a minor in Speech Communication.